Denials Management in Healthcare

Claim denials in healthcare are a common occurrence. Payers can refuse to honor reimbursement requests for varying reasons.

While this is expected, organizations must implement denials management in healthcare strategies as unpaid claims translate to massive losses in revenue.

Claim denial means the refusal of a health insurance provider to honor reimbursement requests for medical services as agreed on the coverage. Upon receipt of the claim, the provider or carrier determines its eligibility, then pays or denies it.

There are two main types of denials in healthcare: hard and soft.

A soft denial is temporary and may be paid once corrections are done or additional information is provided. On the other hand, a hard denial is irreversible and may lead to lost revenue unless repealed successfully.

Multiple challenges impede effective denial management in physician practices and hospitals, such as poorly-trained claim processing staff and lack of automation. These setbacks impact the revenue cycle management, especially the claim billing process.

Common reasons for unpaid claims include:

-

- Late claim submission

- Expired coverage

- Duplicate claims

- Lack of prior authorization

- Inaccurate details (insurance ID)

- Inconsistent data (e.g., diagnosis code not matching the service offered)

- Missing information (modifier, social security number, etc.)

- Poor documentation

While some denied claims are paid after resubmission, health systems incur significant costs. Other denials are never resubmitted or miss the resubmission deadline, leading to lost revenue.

Reports indicate that the cost of resubmitting a denied claim can range from $25-$118 for practices and institutional claims. Adding the cost of initial claim processing, estimated at $6.50, a denied claim can cost $31.50-$124.50.

Without proper denial management, healthcare facilities lose significant amounts of revenue every year, especially considering out of the nearly 20% of denied claims, 65% are never resubmitted.

HFMA Map Keys

The Healthcare Financial Management Association (HFMA) plays a vital role in resolving the challenges of the healthcare financing industry by providing practical resources and guidance. The organization helps individual practice owners and organizations optimize their performance by giving them access to valuable tools, industry analyses, education, and strategic direction.

HFMA operates at the local, regional, and national levels and has drawn together over 100,000 members from diverse fields – healthcare finance leaders, physician practices, provider organizations, payer markets, etc.

Key benefits of HFMA to the healthcare financial industry include:

-

- Offering professional development opportunities and relevant education

- Providing education on the intricacies of running financially healthy healthcare organizations

- Fostering improved healthcare delivery through knowledge of best industry practices and standards

- Ensuring accurate representation of the healthcare finance profession and collaborating with other healthcare associations to address challenges facing the nation’s healthcare industry

HFMA has played a lead role in implementing claim denial management strategies to help streamline the revenue cycle in healthcare organizations. To achieve this, HFMA established the Claim Integrity Task Force and mandated it to formulate HFMA key performance indicators for measuring efforts of denials management.

Some of the HFMA revenue cycle benchmarks include the following HFMA denial rate benchmark:

-

- Initial denial rate (percentage of volume and charges)

- Primary denial rate (denials related to primary health plan)

- Denial write-offs (percentage of net patient service revenue)

- Time from initial denial to appeal (timeliness of the appeal process)

- Time from initial denial to claim resolution (timeliness of the resolution process)

- Percentage of initial denials overturned (measure denial appeal success)

Besides the above benchmarks, there are additional strategic KPIs known as HFMA MAP keys. The metrics apply to the industry stakeholders, including ambulatory providers, hospitals and systems, physician organizations, integrated delivery systems, and post-acute care.

There are 29 MAP keys divided into five groups as follows:

1. Patient Access

-

- Percentage of patient schedule occupied (PA-1)

- Pre-registration rate (PA-2)

- Insurance verification rate (PA-3)

- Service authorization rate – in-patient and/or observation (PA-4)

- Service authorization rate – outpatient encounter (PA-5)

- The conversion rate of uninsured patient to the third-party funding source (PA-6)

- Point-of-service (POS) cash collections (PA-7)

2. Pre-Billing

-

- Days in total discharged not final billed (DNFB) (PB-1)

- Days in final billed not submitted to the payer (FBNS) (PB-2)

- Days in total discharged not submitted to the payer (DNSP) (PB-3)

- Total charge lag days (PB-4)

3. Claims

-

- Clean claim rate (CL-1)

- Late charges as a percentage of total charges (CL-2)

4. Account Resolution

-

- Aged A/R as a percentage of total billed A/R (AR-1)

- Aged A/R as a percentage of billed A/R by payer group (AR-2)

- Aged A/R as a percentage of total A/R (AR-3)

- Aged A/R as a percentage of A/R by payer group (AR-4)

- Remittance denial rate (AR-5)

- Denial write-offs as a percentage of net patient service revenue (AR-6)

- Bad debt (AR-7)

- Charity care (AR– 8)

- Net days in credit balance (AR-9)

5. Financial Management

-

- Net days in accounts receivable (A/R) (FM-1)

- Cash collection as a percentage of net patient service revenue (FM-2)

- Uninsured discounts (FM-3)

- Uncompensated care (FM-4)

- Case mix index (FM-5)

- Cost to collect (FM-6)

- Cost to collect by functional area (FM-7)

Denial Management Process

The denial management process in healthcare identifies the causes of claim denials and implements solutions to prevent future denials. The process seeks to reduce the rate of denials to improve healthcare organizations’ finances.

An effective denial management process involves the following steps:

- Identifying denial reasons – The first step in denial management is establishing the root cause. This can be late claim submission, lack of prior authorization, duplicate claims, expired coverage, etc.

- Categorizing denials – Once you have established the root cause of denial, you categorize them either as soft or hard denials or by the specific reason (coverage issues, submission delay, missing information, etc.)

- Resolving denials – Upon receiving and categorizing a denial appropriately, you should resolve it promptly using laid-out procedures for each category.

- Resubmitting claims – Once you have resolved the reasons for denial, you should resubmit it on time to avoid missing the resubmission deadline.

- Monitoring claims – You should then implement a tracking mechanism to help monitor denials throughout the resolution and appeal process until payment.

- Preventing denials – The most critical part of the denial management process should involve developing preventive strategies to minimize denials in future submissions.

The denials management team can leverage root cause analysis to improve the denial rate. Addressing the root cause enables you to enhance the number of clean claims, increasing revenue collection.

For instance, if the reason for denial was a wrong setting, an analysis of the root cause might discover the documentation did not support care at the inpatient level. Thankfully, advancements in denial management technology have made it possible for teams to use tools like ChatGPT for denials and appeals.

Medical Necessity Denials

Medical necessity denials arise when the service or treatment offered does not satisfy the medical necessity standard.

One of the guidelines for determining medical necessity is that the procedure should not be experimental, unsafe, or inappropriate. Generally, a procedure or treatment qualifies as a medical necessity if provided to diagnose a health issue, prevent injury, or treat an illness per clinical standards of care.

For instance, if a patient goes for an annual wellness visit and receives treatment for another condition, separate documentation is necessary: one for the annual checkup and another for the medical problem, highlighting the medical necessity. Otherwise, combining the two can lead to medical billing denials and actions.

But often, medical necessity is much more ambiguous based on payer criteria. Some of the claim denials and solutions you can implement to lower medical necessity include:

-

- Improve documentation – The importance of documentation in healthcare cannot be overemphasized, especially in curbing medical necessity denials. Medical necessity documentation should always be complete, accurate, and specific to support the billed service. Especially when it comes to criteria for hospital admission, appropriate documentation can close a huge gap in lost revenue because of inpatient versus observation statuses.

- Prior authorization – Verifying patients’ demographics and benefits covered before rendering service should be a key step in the medical delivery process as it helps minimize the rate of denials.

- Have a coding expert – Working with a skilled coder is essential to capture accurate codes. They can be in-house or outsourced but should be knowledgeable in the payer policies and contracts and local and national coverage determination codes.

- Updated billing software – The billing software should always be up-to-date with new codes to avoid relying on obsolete information.

Denials Management Software

Uncovered benefits, coverage ineligibility, duplicate submissions, and incomplete submission are some leading causes of a claim denial. One way of avoiding this is investing in denials management software to resolve the issues at the source.

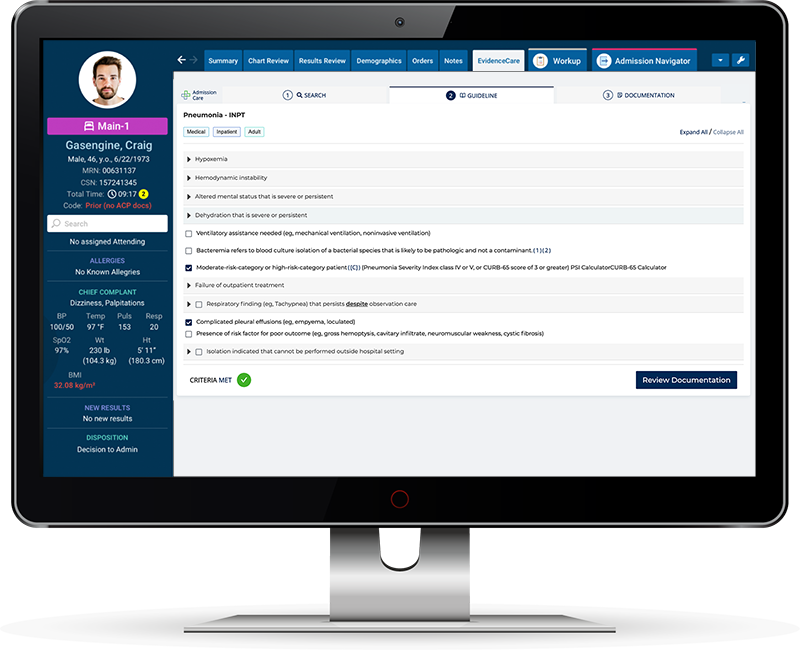

For instance, the software can enable payer criteria at admission, eliminating the risk of putting patients in the wrong bed status. It can also integrate with your clinical documentation software to avoid the issues of incomplete documentation.

With medical necessity documentation software like AdmissionCare, you can streamline your denial management workflow to reduce revenue loss. AdmissionCare empowers physicians to facilitate appropriate admissions by fixing bed status documentation issues at the source.

Notable benefits of using AdmissionCare software include the following:

-

- Reduced documentation queries and medical necessity denials

- Accelerated handoff between emergency and in-patient teams

- Increased payer reimbursements

- Improved patient satisfaction

- Better physician retention due to reduction in burnout

For more information on how AdmissionCare works, schedule a demo.